Source: Indianapolis Business Journal

Until this year, coding was not in entrepreneur Cornelius George’s skill set. But he said he’s now handling much of the coding for Chuqlab, the Indianapolis-based tech firm he co-founded in 2019. His secret? Artificial intelligence.

He discovered an AI-powered coding tool called Blitzy, sought out peers to learn from, and uses a consultant as needed.

“I couldn’t write a lick of code at the beginning of the year. Not a single word,” George said. “Now, I can do pretty much everything that I need to do.”

The company, which in the past had as many as eight employees, now operates with a staff that varies from three to five people.

Chuqlab is an example of an emerging dynamic: AI is upending the equation for startups, making it less expensive to start and operate a company—and potentially reducing these startups’ reliance on venture funding. Chuqlab offers AI-powered tools to help law enforcement agencies comb through enormous volumes of data from jailhouse phone calls, videos and photos to find evidence and crack cases that might otherwise go unsolved.

George said he also uses AI tools for tasks like marketing and website design.

“The level of efficiencies that we’re able to have because of AI, it is just unparalleled,” he told IBJ.

To date, George said, Chuqlab has raised about $650,000 from various sources. He said the company hasn’t yet raised a major funding round, and he hasn’t determined when and how much it might raise. But thanks to AI, that number will be smaller than it would have been otherwise.

“You can definitely slice it in half, what you would have raised before,” he said.

At some point, George said, he’ll seek a major funding round. That funding will go toward networking and deal-making activities to fuel Chuqlab’s growth—expenses like attending conferences and traveling to meet with customers and potential customers face-to-face.

“There’s certain things that you just can’t do with AI,” he said.

‘That’s insane’

Jake Miller of Indianapolis, a serial tech entrepreneur, offers an even more dramatic example of AI’s influence on startups.

In late 2021, about a year before generative AI tools like ChatGPT became widely available, Miller launched The Engineered Innovation Group, an Indianapolis-based software development firm that helped its clients innovate and develop software-as-a-service, or SaaS, products. At its largest, The Engineered Innovation Group had a staff of 45. But, Miller said, the company found itself in a landscape that was being reshaped quickly by AI, and it was too large to easily pivot.

“It was something that we, frankly, struggled to keep up with, because it changed so freaking fast,” he told IBJ.

The Engineered Innovation Group ceased operations in June.

In August, Miller launched Zivis LLC, which focuses on AI security, scalability, ethical and reliability issues. Miller said he expects to launch the company’s software platform this month.

He and his co-founder, fellow entrepreneur Jim Goldman, run the entire operation, Miller said.

AI is enabling Zivis to function at a pace that would have been impossible just a year or two ago, and at much lower cost. What might have cost $500,000, he said, now costs about a tenth of that.

“Whereas before, we would staff a five- to 10-person team, and it would take them three to six months to have a product in market. Now I’m doing projects on my own, writing code that would replace the [output of] the whole team, and getting it done in a month. That’s insane,” Miller said.

He and Goldman have not accepted outside funding so far, he said, and are in no rush to do so.

Miller did acknowledge that the dramatic productivity gains and cost reductions are possible in part because he and Goldman each bring the advantage of decades of experience.

“I think someone that was younger, they would need some sort of funding,” he said.

‘More with less’

AI’s effect on startups is also evident to Indianapolis-based venture studio High Alpha. The firm creates, launches and funds software-as-a-service, or SaaS, startups, and it also invests in existing SaaS firms.

“You can build a lot more product with far smaller teams for a lot less money than you used to,” said Kristian Andersen, a High Alpha co-founder and partner. “We’re certainly seeing early-stage companies do more with less.”

But that dynamic does not necessarily hold true for all types of companies, Andersen said. One that is building a complex and AI-focused product, he said, might not be able to delay seeking funding because that type of product takes longer to develop.

Another factor to consider: Outside of the hot AI companies that are raking in investments, venture funding is harder to come by now than it was a few years ago. That reality is helping drive startups toward AI tools, Andersen said.

“If you are not a hot AI-native company, it is likely going to be more challenging for you to raise money than your peer across the street that has more of a pure AI growth story, and as a result of that, you realize, ‘I’ve got to make a dollar stretch further,’” Andersen said. “‘So I’m going to be more creative. We’re going to do more with less. We’re going to outsource more. We’re going to lean on these kind of AI productivity tools to drive new efficiencies from the top to the bottom of the business.’”

High Alpha’s 2025 SaaS Benchmarks report, to be released next week, shows that SaaS companies of all sizes are reducing their headcounts because of AI. In that report, more than half of respondents said their use of AI spurred them to trim their workforce.

Among the smallest companies, or those with annual recurring revenue of less than $1 million, 55% of respondents said their company had reduced headcount. Among companies with annual recurring revenue of $1 million to $5 million, 56% of respondents reported staff reductions.

Staff reductions were most common, at 76%, among the largest companies—those with annual recurring revenue of more than $50 million.

Also from the High Alpha report: 42% of respondents said they had reduced their engineering headcount as a direct result of AI. The other two job functions most affected by AI-related staff cuts were customer service (27%) and support and marketing (26%). Responses to this question were not broken out by company size.

The report is based on responses from more than 800 people working at SaaS companies. Of those, half were company CEOs or founders. Another 28% led their company’s finance or operations activities, and the other 22% held a variety of other roles. Just over two-thirds, or 69%, of the respondents were U.S.-based.

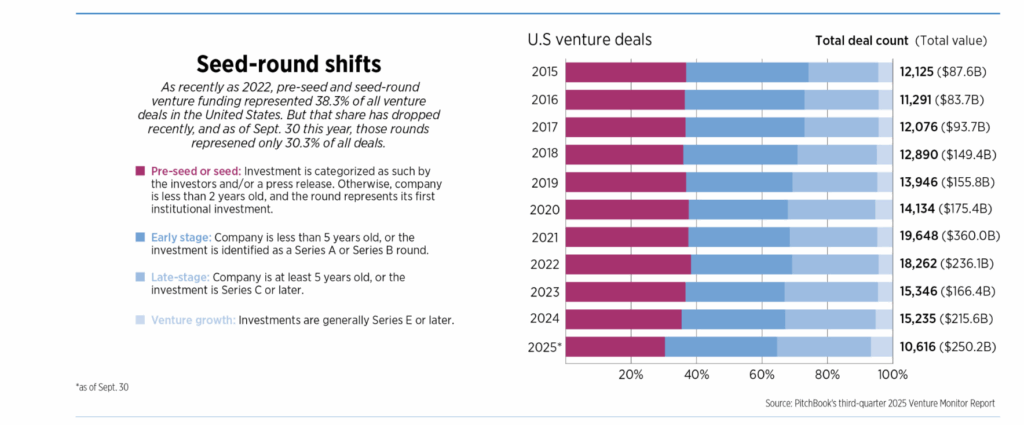

PitchBook’s third-quarter Venture Monitor Report, released last month, shows that the earliest-stage venture investments—the pre-seed and seed rounds—make up a smaller percentage of total venture funding this year than they have in the past few years.

As of Sept. 30, the PitchBook report says, pre-seed and seed rounds accounted for 30.3% of all U.S. venture deals. That percentage had consistently been above 35% the previous 10 years, topping out at 38.4% in 2022.

A changing landscape

The PitchBook report does not link the decline in early-stage funding to AI, but Tejas Vijh, a North Carolina-based senior investment analyst with Indianapolis-based Boomerang Ventures, draws a straight line between the two.

Boomerang invests in early-stage Midwestern health-tech startups. The firm’s average investment is about $1 million. Boomerang makes seed, seed-plus and Series A investments in existing companies. It also operates a studio out of which it launches startups and provides them with pre-seed funding.

Previously, Vijh said, a tech startup might have had to raise venture funding so it could hire the talent to build what the industry calls a minimum viable product, or MVP—a basic version of the product it can use to test the market and gather customer feedback. But AI-powered coding tools now allow more people to create MVP products without a team of experts.

Put another way, Vijh said, a startup that a few years ago might have needed $2 million in funding to develop its MVP can now likely do the same thing with around $200,000.

“Because of AI, early-stage companies have been able to build faster and leaner, and they can either raise [investment funding] later or raise smaller [amounts]. And this has, I think, become very common the last 12 to 18 months.”

Vijh said AI is also changing up other parts of the venture funding landscape.

For one, he’s seeing people without deep tech expertise launching tech companies, because AI coding tools have made it easier to get in the game.

The new ease of coding also means investors must evaluate potential investments through a slightly different lens, Vijh said.

“From our point of view, the model is getting recalibrated,” he said.

The focus now, Vijh said, is more on the strength of the founding team and how well the startup will be able to defend itself against competitors.“We look at how you can scale in a world where many can copy the tech,” he said.

One particular challenge for investors, Vijh said, is trying to determine whether a startup’s product is likely to be supplanted by a similar product developed by a larger company. A startup that builds an AI agent that can accomplish a particular task, for instance, could be wiped out if OpenAI or Salesforce develops its own AI agent that does something similar.

“This is something that we can only assess to a particular level and cannot be sure about—would this company still be relevant after two years?” Vijh said.

Source: Indianapolis Business Journal, November 7, 2025, Susan Orr